- Morning Watchlist

- Posts

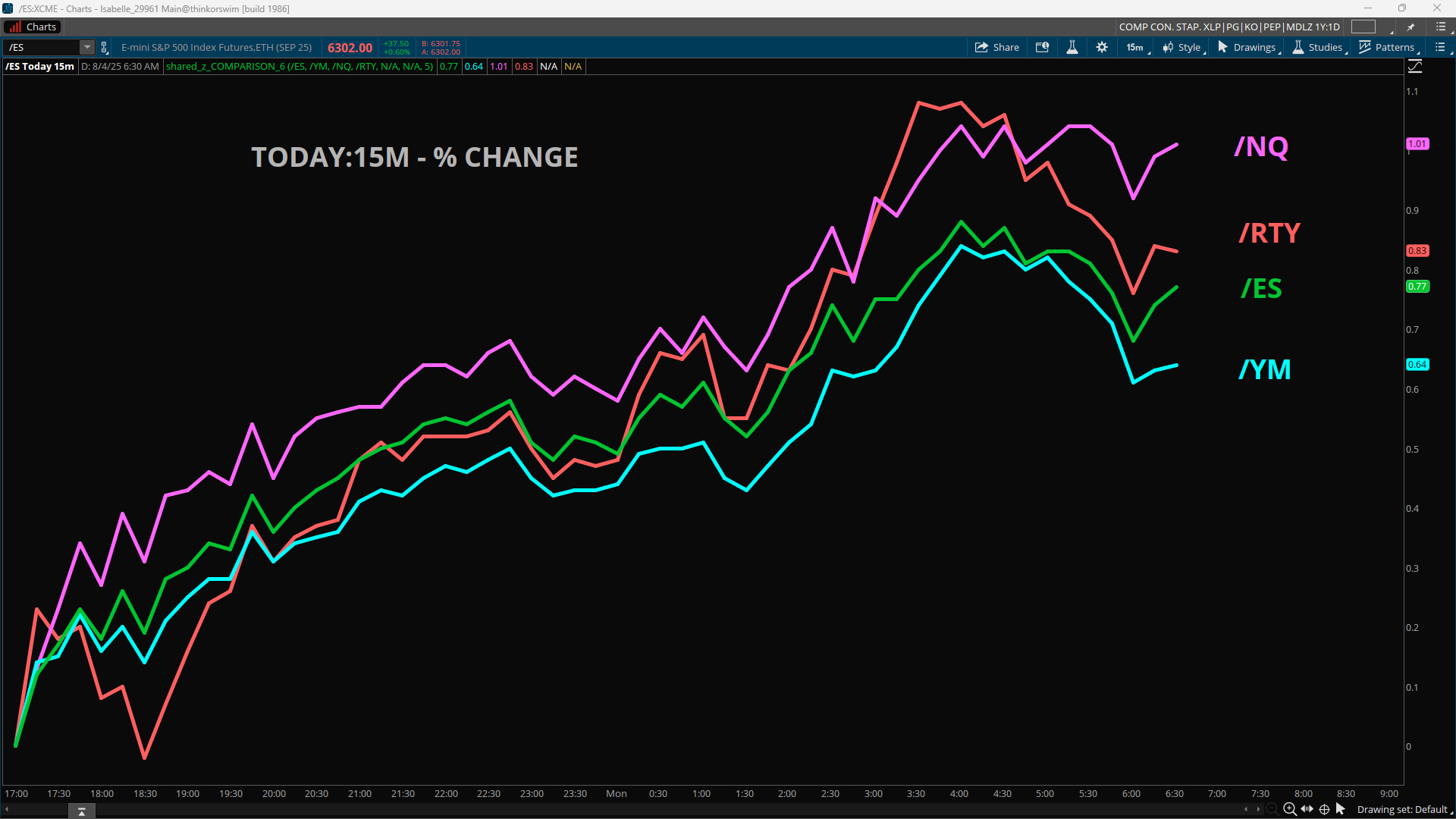

- Bouncing Back from Friday's Sell-Off?

Bouncing Back from Friday's Sell-Off?

U.S. stock futures are higher in premarket trading as markets attempt to rebound from the steep losses seen in Friday’s session that were sparked by concerns over the economy and a new round of tariffs from the Trump administration. Friday’s worse than expected jobs data and the massive drop in revisions left stocks deep in the red last week.

Friday’s sell-off was also driven by uncertainty about President Donald Trump’s new modified tariff rates. Trump signed an executive order late last week that updated his “reciprocal” tariffs on dozens of U.S. trading partners, ranging from Syria to Taiwan, with updated duties ranging from 10% to 41%. The CBOE Volatility Index (VIX) spiked 22% on Friday and settled at its highest level in six weeks.

Morning Movers

Snapshot (as of 7 AM ET)

Oil (/CL) – Oil prices are down around 2% near $66 a barrel after OPEC+ agreed to another large output hike in September, though traders remained wary of further sanctions on Russia. OPEC+ members agreed to increase oil production by 547K barrels per day in September. The eight OPEC+ member states continue to scale back the 2.2 million barrels a day output cut they agreed in 2023. Production quotas have been boosted in recent months and on Sunday, the group agreed to boost oil production by 547K barrels a day next month. OPEC+ repeated that the phase-out of the additional voluntary production cuts may be paused or reversed subject to evolving market conditions. Indeed, Bloomberg reported that "delegates emphasized privately that the next move could just as easily be a cut as a hike."

Gold (/GC) – Gold prices are up over 0.5% near $3,420 as the dollar fell following weaker-than-expected U.S. jobs data that boosted expectations for a Federal Reserve interest rate cut in September.

Bitcoin (/BTC) – The Crypto Future is up over 1% near $114.8K in the premarket.

VIX – The CBOE Volatility Index spiked higher by 22% on Friday and settled at 20.38 as stocks sold off. It was the highest closing price for the VIX in six weeks.

U.S. Dollar (/DX) – The dollar is 0.3% lower to 98.6.

Biggest Premarket Movers

Symbol | Product | Mark % Change (as of 7 AM ET) |

|---|---|---|

IDXX | Idexx Labs | +8.30% |

APH | Amphenol | +3.55% |

SMCI | Super Micro Computer | +2.82% |

ON | On Semiconductor | -0.74% |

BX | Blackstone | -0.60% |

BRK/B | Berkshire Hathaway | -0.60% |

Economic Data

Time | Event |

|---|---|

10:00AM ET | Factory Orders |

11:30AM ET | 3-Month Bill Auction 6-Month Bill Auction |

Notable Earnings

Premarket | Postmarket | Premarket Tomorrow | Postmarket Tomorrow |

|---|---|---|---|

BNTX, CAN, ENR, IEP, ON, TSN, W | ACM, AL, ALGT, BMRN, CTRA, HIMS, KD, MELI, OKE, PLTR, PAY, SBAC, SPG, RIG, TREX, VRTX, VMEO, VNO, VMEO, WMB | APO, ARMK, ADM, BALL, BLDE, BP, CAT, CCO, CMI, DAN, DOCN, DUK, DD, ETN, ERJ, EVGO, EXPD, FIS, FOXA, ULCC, GFS, HSIC, J, LDOS, MPC, MAR, TAP, PFE, PTLO, SBH, FOUR, TDG, EVTL, SEAT, WLK, KLG, WW, YUM, ZBRA, ZTS | AMD, AFL, AMGN, ANET, CHGG, CC, CRUS, CLOV, DVA, DVN, FLYW, GO, GXO, IFF, LCID, MASI, MTCH, MOS, NWS, OPEN, PCTY, RVLV, RNG, RIVN, SWKS, SNAP, SU, SMCI, TDC, TOST, UPST, VSAT, ZETA |

Upgrades/Downgrades

Phillip Securities upgrades Spotify (SPOT) to Neutral from Reduce

Wells Fargo upgrades Doximity (DOCS) to Equal Weight from Underweight

Compass Point downgrades Coinbase (COIN) to Sell from Neutral

Stifel downgrades Baxter (BAX) to Hold from Buy

Tune in live from 8 a.m. to 5 p.m. ET, or anytime, anywhere, on‑demand.

Or stream it via thinkorswim® and thinkorswim Mobile, available through our broker-dealer affiliate, Charles Schwab & Co., Inc

Please do not reply to this email. Replies are not delivered to Schwab Network. For inquiries or comments, please email [email protected].

See how your information is protected with our privacy statement.

This material is intended for informational purposes only and should not be considered a personalized recommendation or investment advice. Investors should review investment strategies for their own particular situations before making any decisions.

Schwab Network is brought to you by Charles Schwab Media Productions Company (“CSMPC”). CSMPC is a subsidiary of The Charles Schwab Corporation and is not a financial advisor, registered investment advisor, broker-dealer, or futures commission merchant.

Charles Schwab Media Productions Company and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.

Data contained herein is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed. All events and times listed are subject to change without notice.